Market Replay is asimulatorthat uses historical data to emulate a trading process.

Market Replay allows you to:

- practice your chart-reading skills

- create new strategies and/or improve existing ones

- practice the accuracy of entering and exiting a trade until it becomes second nature

- increase psychological stability, learn to control risks and manage capital more effectively

- analyze errors and find ways to eliminate them

- test trading robots.

How to run the Market Replay Simulator

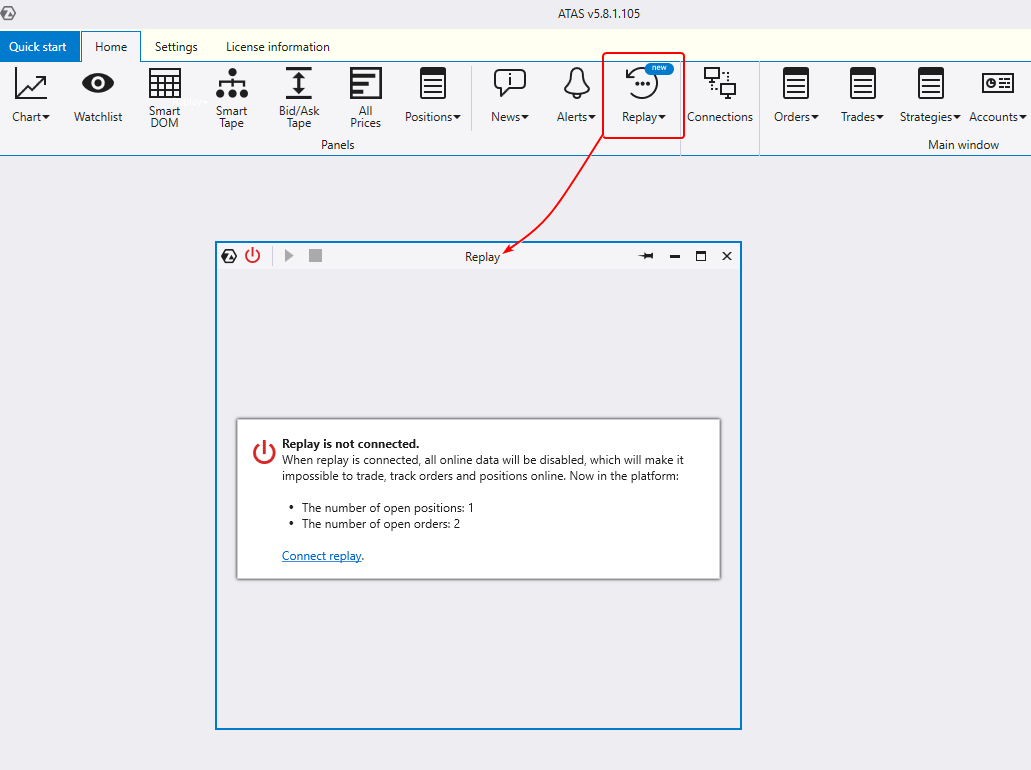

1. Click the Replay button in the menu of the main program window.

The Replay window will appear.

You will see a notification saying that Replay is not connected.

ATAS uses the Windows system clock by default. When you enable Replay mode, you create an alternate time source thatdeactivatesthe built-in system clock. This makes it impossible to update charts in real time and get information related to your real positions if there are any. Therefore, we recommend separating work in the real market and training in the Replay mode.

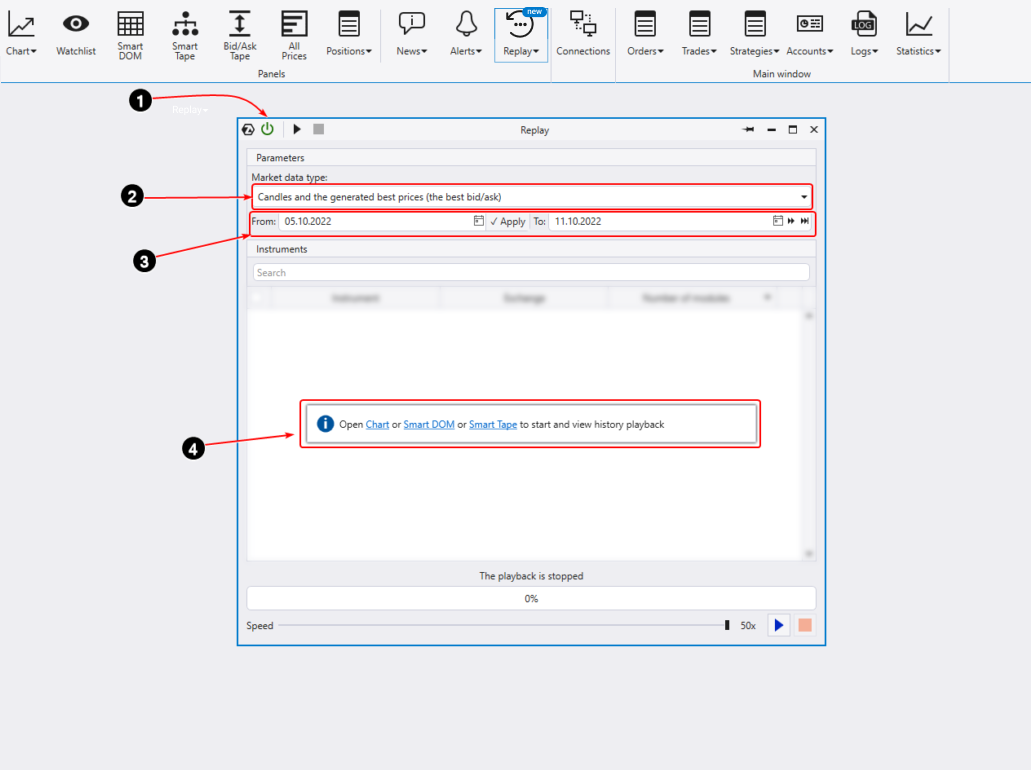

2. Activate the “training” mode by pressing the red power button in the header of the Replay window (1)

Then specify the history type (2). Three options are available:

- Ticks + DOM. You get complete data for the highest possible accuracy. However, the downside is that you will need to spend time waiting for the necessary amount of data (which is quite large) to be downloaded from the ATAS servers to start Replay on your computer.

- Ticks + generated DOM. This is the best option for training strategies that do not use limit orders from the DOM (market depth, or Level II).

- Generated ticks and the DOM. This is the fastest way to get started. It is good for practicing simple strategies (for example, based on basic technical analysis patterns) without advanced volume analysis.

Set the dates for the replay (3). All terabytes of the most detailed historical data from various exchanges stored on ATAS servers (!) are available for the replay.

Open the chart of the instrument you are interested in by clicking on the Chart link (4). You can also open Smart DOM or Smart Tape.

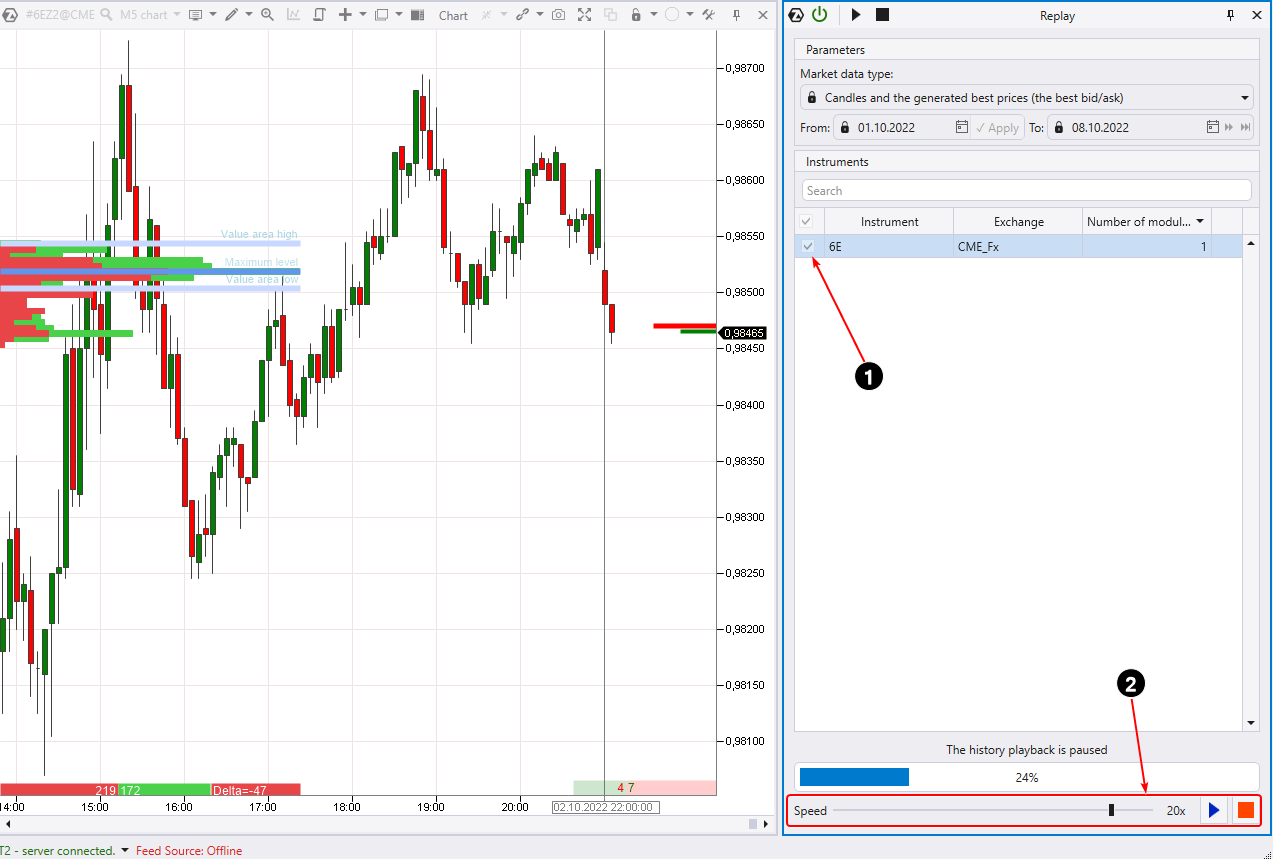

3. Start the replay.

Tick the modules that will be used in the simulator (1).

To start the replay, press the Play button on the Replay control panel (number 2 above). The chart will begin to playback the exchange trades for the specified time period. It is also possible to control the speed and pause the playback.

When you click Stop (red square), the “training” will finish.

How to trade in Market Replay

Exchange simulation can be used to build strategies or to test the performance of indicators and patterns. But in the end, it all comes down to making decisions about trades. Therefore, the possibility of making trading operations in the Market Replay mode is provided.

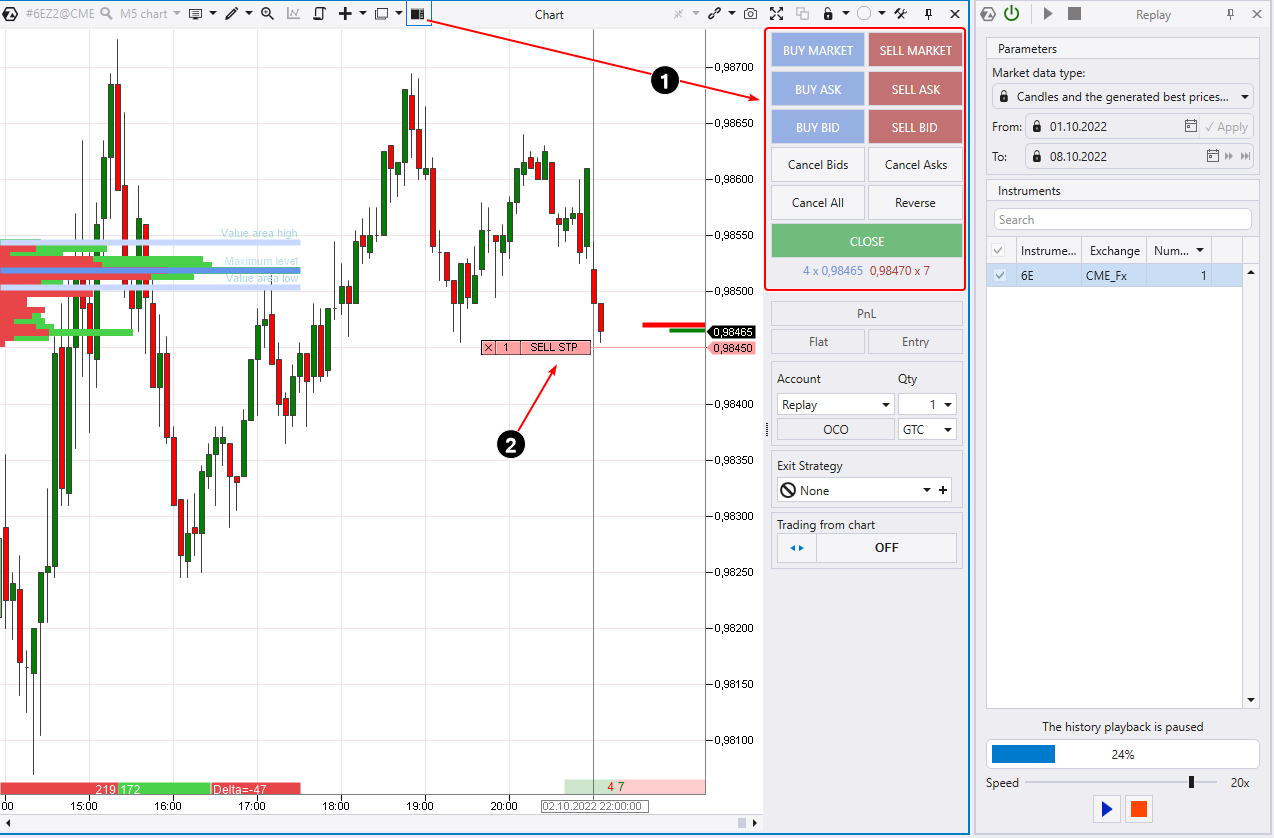

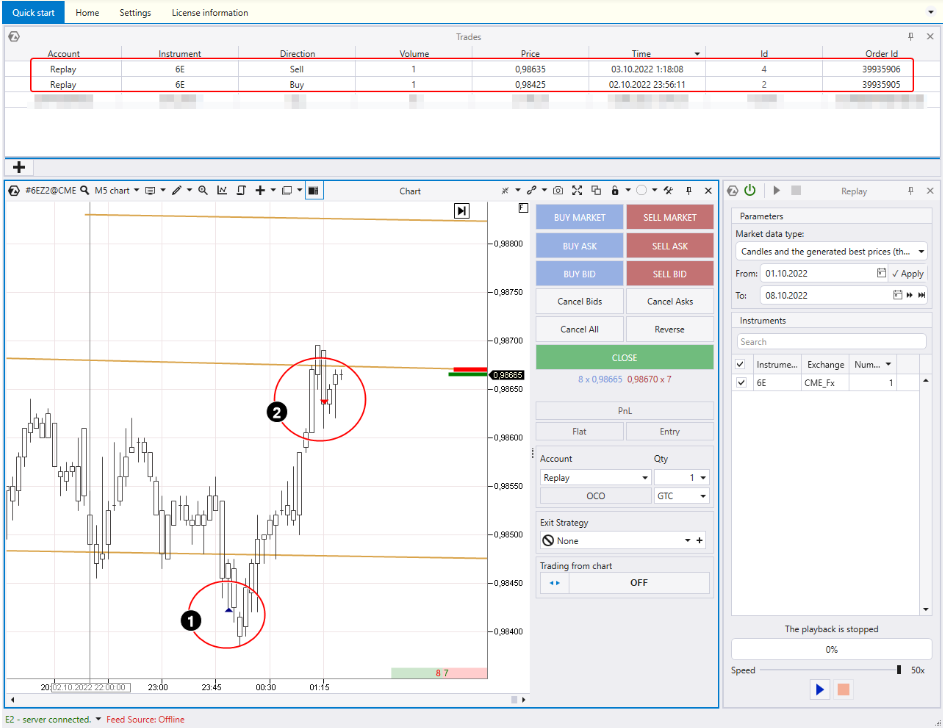

To open the Chart Trader trading panel, press “T”, or the corresponding icon in the menu (1).

You can place a limit or stop order (number 2 above) in other ways which are clearly demonstrated in the article about ATAS Trading Opportunities.

To start trading, you need to open a separate Replay Account. This is where your trades made in the trader s simulator will be recorded. Trades will also be displayed on the chart.

Then you can analyze your performance in the statistics module (profit factor, drawdowns, and other indicators).

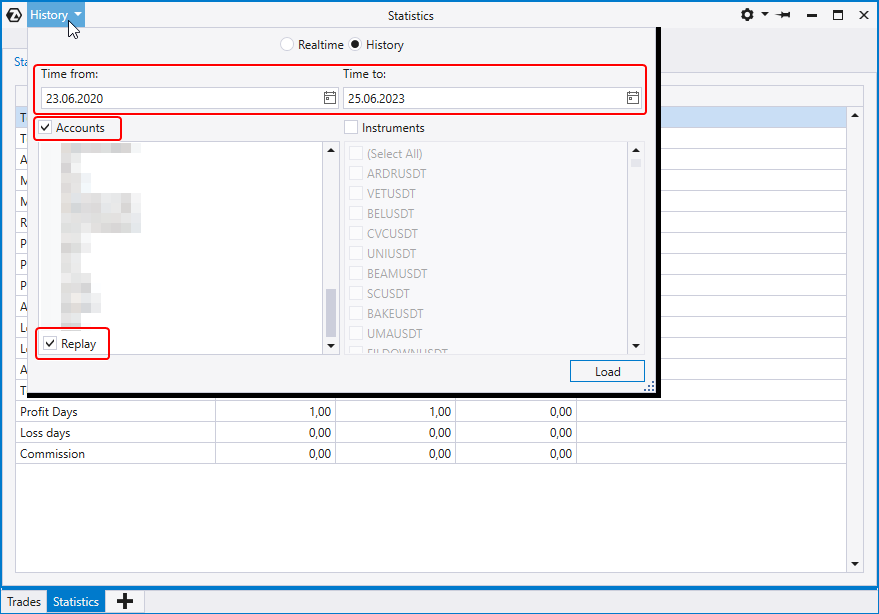

To analyze trading statistics in Market Replay, you need to select an Account Replay account, and, if necessary, apply additional settings (as shown above).

Please note, since there is only one Account Replay account, each next training session will reset the results of the previous one.

Existing restrictions

1. Demo license – it is valid for 14 days from the moment you installed the ATAS program.

Market Replay has limited functionality:

- only one instrument is available

- history depth limit = 1 week

- all three replay modes are active.

2. Expired demo license. After 14 days from the installation of the ATAS program.

- one instrument

- history depth = 1 day

- all three replay modes are active.

3. Paid tariff.

- five instruments

- history depth = 3 months

- all replay modes are available.

4. Lifetime license.

- number of instruments = 20. Other restrictions are removed.

FAQ

Is it possible for traders to train on forex?

Forex is an interbank spot market. The ATAS platform can only connect to exchanges (NYSE, NASDAQ, CME, EUREX, MOEX, cryptocurrency and other exchanges). Therefore, it is impossible to connect to Forex through ATAS. However, if you are a forex trader, you can “train” in the ATAS Market Replay simulator using data from the currency futures market that correlates exactly with the spot forex market. For example, euro futures.

Is it possible to test trading robots?

Yes. ATAS provides the ability to connect trading robots via API. You can get an idea about this feature by reading the article Algorithms for ATAS.

Do you take slippage into account?

No. Slippage and market liquidity are too unpredictable things to model. The ATAS Market Replay exchange simulator assumes ideal conditions for trades, but in reality, slippage can be to your advantage or not.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article